It’s no secret that car insurance for young drivers is significantly more expensive than it is for experienced adult drivers. If your son or daughter recently got their license, you’re probably fretting about the costs associated with adding them to your car insurance policy. While the added costs of a student driver on your insurance policy could definitely put a serious dent in your monthly budget, they don’t have to be as astronomical as one might think. In fact, there are a few courses of action that you could take to mitigate...

You Are Browsing ‘Saving & Spending’ Category

Often, when people think about charities, they think about fundraisers for charities. Many charities hold events throughout the year to collect money for organizations of their choice. It is always possible to think outside of the box when it comes to collecting money for a charitable organization. Donations are another good way to provide help to organizations that aid worthy causes. Collecting boats for charity, like boat angel,is a unique idea that can be pulled off with a little work setting up. Find a Worthy Cause The first thing...

Now more than ever before, a wide variety of financial resources are available to the general public, providing the basic information necessary to begin an investment portfolio. Many individuals that have become successful investors claim to be self-taught, learning how to be their own investment manager through tutorials available on the internet and by reading textbooks and manuals available at their local libraries. To many of us, this success sounds too good to be true, but more seasoned economic experts are not surprised by this...

Did you know that saving money is as easy as installing applications on your phone? New apps help you save money on the go and stay more conscious of your spending and saving activity. Take a look at some of the most popular mobile apps for cost-cutting that will help you stay on budget! Shopkick Shopkick gives you rewards points for buying particular items or simply for walking into stores like American Eagle and Macy’s. Cash those rewards points in for gift cards you can use towards purchases. This application is as simple as turning...

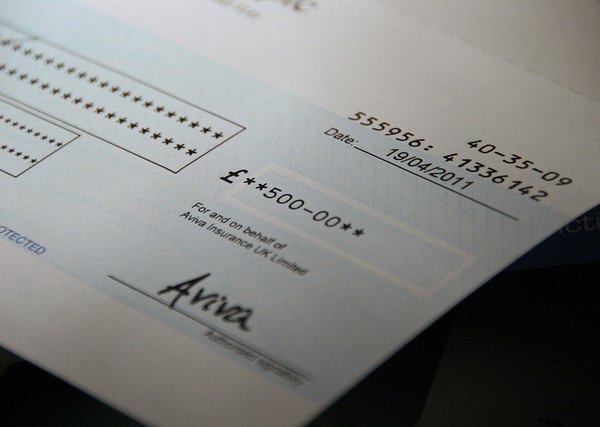

It goes without saying: maintaining a good credit rating is essential to obtaining mortgages or loans in the future. Most people understand what can affect their credit rating: missed payments, bankruptcy, and so on. However, there are a number of unexpected factors that can affect your credit score that; hitherto, you may have been unaware of. Closing a credit card account Closing a credit card account can have a major effect on your credit score. While you might think that it’s a good idea to get rid of accounts that you no longer...

Money Management is a MUST during this trying/difficult economic times and every individual or business enterprise should always go for cost effective measures to manage cash position. A business owner or individual should spend their money on interest bearing things or items and should identify NEEDS and WANTS. Spending beyond our earning or sales capacity and uptick in prices of goods, raw materials & gasoline could cause business bankruptcy or emotional stress. On a personal point of view, everyone should understand their buying...

Whoever said never put all your eggs in one basket definitely owns a lot of eggs. Ideally, all money should not be placed solely in the bank or in real estate or stocks and even in jewelry. As much as possible, money should be placed in different forms of investment to avoid significant loss. As a result, more and more people are investing in jewelry, particularly diamonds, because of its accessibility and value. According to Shirley Bassey, diamonds are forever. Marilyn Monroe also said diamonds are girl’s best friend. Even Rihanna...

It’s true that life sometimes doesn’t pan out like you thought it may. It’s only human nature that people grow and develop, learning that they had passions for things they never thought they once had. This may lead people to investigate the possibility of further education at a later stage in life; either training in a completely new subject or honing their skills in a specific field. However, further education is not the cheapest of lifestyle choices; degrees usually costing anywhere from 20K-50K. However, if your heart is set...

Whether obtaining a home purchase loan or a traditional refinance, there are fees that must be paid for this service. These fees, which represent various services that are a part of putting the loan together, generally fall into different categories. Basically, understanding third party fees in a mortgage will also give a clearer picture of the amount of work that must be performed in order to reach a mortgage approval. Below are 8 common third party fees that are charged to mortgage borrowers: 1. Appraisal Fee The appraisal fee is the...

Purchasing a vehicle is a big step, not only because it becomes your responsibility to maintain and keep running, but because it’s most likely the second biggest expense you will ever pay out after your home. When it comes to financing a car, not everyone can afford an instant payout. Debts and depression are usually the fears that spring to mind when discussing purchasing a vehicle on finance, however when handled in the correct way, there are many options that you can tailor to your own individual lifestyle. How much can you afford? The...